Launch of the ESCAP Economic and Social Survey of Asia and the Pacific 2011

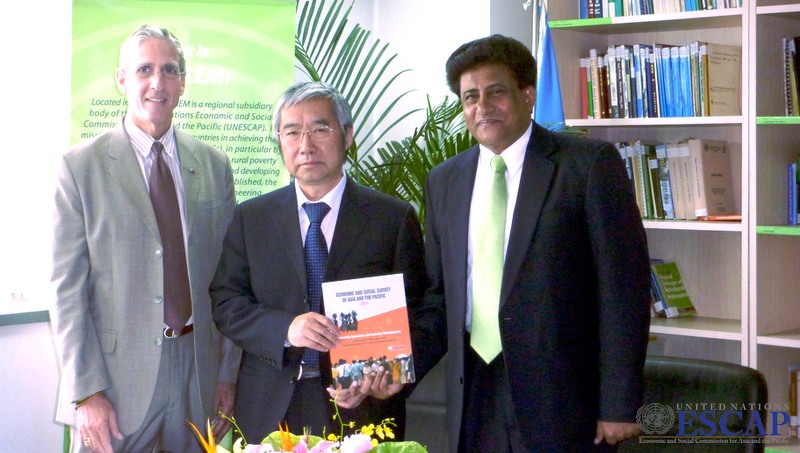

The launch of the United Nations Economic and Social Commission’s (ESCAP) flagship publication titled Economic and Social Survey of Asia and the Pacific 2011 was held at the United Nations Asia and Pacific Centre for Agricultural Engineering and Machinery (UNAPCAEM) in Beijing on 5 May 2011.

The 2011 edition of the Economic and Social Survey of Asia and the Pacific, the oldest annual review of development in the region, analyzes the economic recovery of the region thus far and the critical issues, policy challenges and risks facing the region in the coming months. The flagship publication of the Economic and Social Commission for Asia and the Pacific (ESCAP) – the regional arm of the UN – outlines policies to sustain dynamic growth and to make it inclusive, such as: boosting internal demand, enhancing connectivity to create a seamless and region-wide market, and building productive capacities in the least developed countries.

The UNAPCAEM Launch was attended by members of the UN China Country Team, including UNICEF, UNAIDS and UNDP, and covered by international and Chinese media with representatives from Reuters and Bloomberg, Caixin, Phoenix TV, and the Global Times. The event kicked off with an opening speech for the UNAPCAEM’s Director, Mr. LeRoy Hollenbeck who introduced the Centre and its work, followed by Mr. Aynul Hasan a Section Chief from ESCAP’s Macroeconomic Policy and Development Division, who noted in his presentation that “faced with rising food prices, governments should instead draw on a variety of fiscal measures, such as food vouchers and lower taxes, that could help the poor. He also said that “efforts must also be made to boost agricultural productivity over time by, for example, investing in research and development”.

Rounding out the presentations at the Launch, Dr. Yu Yongding an eminent and outspoken economist from the Chinese Academy of Social Sciences (CASS) spoke of China not utilizing its domestic capital well, and instead using borrowed foreign money at higher cost and investing mainly in low return foreign assets such as US treasuries. Dr. Yu also highlighted that the average investment return for multinational companies in China is 24 per cent, according to the World Bank, which means that China is paying 24 per cent annually for foreign capital used.

The Launch closed with a round of Q&A from the media, with questions on a variety of topics linked the Chinese economy including the future of apartment prices, expectations for the yuan, and the growing gap between rich and poor in China.

For more information, please visit the following Web site: http://www.unescap.org/Survey2011